Hi Investors – “Rent to Own Homes” are an excellent vehicle for both buyers and sellers to take advantage of in real estate. However, some folks throw around those 4 words in a haphazard manner with no thought behind it. When that happens, it opens the door to bad things, and some bad folks trying to profit on the backs of innocent people. Let me explain…..

Hi Investors – “Rent to Own Homes” are an excellent vehicle for both buyers and sellers to take advantage of in real estate. However, some folks throw around those 4 words in a haphazard manner with no thought behind it. When that happens, it opens the door to bad things, and some bad folks trying to profit on the backs of innocent people. Let me explain…..

I’ve been in the real estate investing business – and an especially high advocate for this alternative financing method – for over 10-years. You should be fully convinced that I take the phrase, “Rent to Own Property”, quite seriously, and I cannot stress enough just how important it is to sort out all of the facts and responsibilities of all parties, just as in any other business contract.

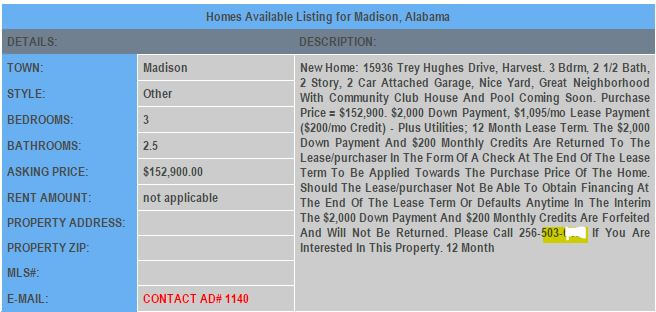

Here is an example of an actual “Rent To Own Real Estate Deal”, located in a new subdivison, that I had listed on my site:

Look at the the real esate ad carefully. Do you see the Investor/Seller included all the major financing & leasing terms and lengt of lease? What other information should the investor have included in his rent to own contract? Aware of any terms or conditions that could not be included in a lease to own contract?

Rent To Own Contract Considerations

There are certain things that the Seller/Homeowner must do, as well as certain things that the Prospective Tenant/Buyer must do, but most importantly, these things must be coordinated between both of the parties. Ignoring these things are the sure sign of legal repercussions down the road, for both parties.

In an aptly-named article, “Questions to Consider If looking to Rent-to-own”, Joanna Jackson, a sales manager/associate broker with Jackson Realty, wrote up a concise breakdown of these specific items.

Basically, as you might imagine, these run the gamut between – “Who fixes the toilet bowl, who pays for the handyman, and plenty of “What If?” scenarios.

Jackson lists the following items the Investor/Seller will need to consider with a Rent To Own/Lease Option To Buy Deal:

- Who will tend to the property?

- Pay for routine maintenance?

- Pay for major repairs?

- Will you be managing the property? Hire a Property Manager?

- Will you hire a real estate agent?

- (and what are the costs of those two routes)?

- How much does it cost to set up and manage an escrow account for the portion of rent allotted to the down payment/taxes/existing loans?

- What if the renters bail on you?

- Who keeps the money in the escrow account?

- If the buyers change their minds, what will be required to put the property back on the market for sale?

Jackson also lists some of the items that need to be well thought out by the Tenant/Buyers when they find their ideal home and are considering a Rent To Own/Lease Option To Buy financing alternative:

- How much, if any, of the rent is going to the down payment?

- What if you change your mind? (How locked in are you if you change your mind?)

- What will it cost you to get out of the deal, if needed?

- How long will it take to accumulate enough of a down payment to help you towards qualifying for a mortgage?

- Who is responsible for paying the property taxes (and other local taxes) and insurance on the property?

Setting Up Rent To Own/Lease Option Deals Advice

These are all very open-ended questions with no Right or Wrong answer; however, there are certain local “traditions” or procedures that vary from state to state and sometimes even county to county. I fully concur with Jackson, who states that when “considering a rent-to-own deal, seek legal advice from a real estate attorney” to set up the deal. I go one step further and suggest an attorney that is local to the property, and thus, the local laws.

These are all very open-ended questions with no Right or Wrong answer; however, there are certain local “traditions” or procedures that vary from state to state and sometimes even county to county. I fully concur with Jackson, who states that when “considering a rent-to-own deal, seek legal advice from a real estate attorney” to set up the deal. I go one step further and suggest an attorney that is local to the property, and thus, the local laws.

Although these above-mentioned items can seem a thorn in your side, remember one thing; these are what make a Rent to Own Deal an actual “Rent to Own Deal”, vs. a shady open-ended agreement with many gray areas, which can stop you from selling your home, or, can stop you from obtaining your dream home. Nail it down the first time so everyone walks away happy!

We love your feedback and welcome your comments.

Please post below: