How Does Private Money Lending Work When Funding a Flip?

How Does Private Money Lending Work When Funding a Flip?

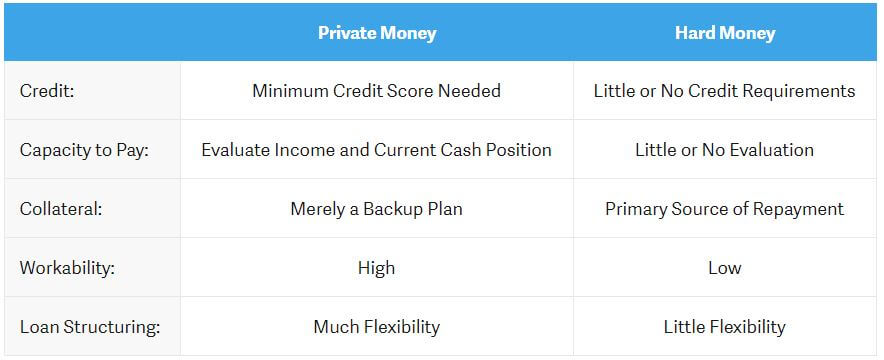

Many people in the investment property rehab business think that private money rehab lenders and hard money rehab lenders are the same. They are actually different in many ways and by understanding the difference, you can gain a better understanding of what happens behind the scenes and choose the best option for you.

A private lender will generally review a potential borrower and collateral property using the three Cs of the lending world: credit, capacity to pay, and collateral. This means that the private lender will need to qualify the borrower financially by reviewing the borrowers credit history to assess the borrowers habits in paying back creditor, as well as the borrowers cash on hand and income and will also evaluate the strength of the real property being offered as collateral.

Additional categories, such as workability and the actual structuring of the loan will weigh heavy in the decision on which lender to go with. We have put together the below visual to explain the differences between the two funding sources:

Credit

A private money lender will generally look for a minimum credit when considering approving a loan. The better the credit score, the more inclined a private lender will be to make a loan. With that said, the history matters just as much as the score, and mortgage late payments, bankruptcies, foreclosures and other derogatory items can be detrimental in your efforts to obtain funding. The typical hard money lender is only looking at the collateral as the primary source of repayment of the loan if the borrower does not pay.

Collateral

The private lender makes loans that it expects the borrower to repay, with the collateral serving merely as the backup plan to repayment if something unexpected happens and the borrower does not repay. Consequently, the private rehab lender may be willing to lend a greater amount on a particular project than a hard money rehab lender, as the private lender is more confident of the borrowers ability to repay. The typical hard money lender is looking at the collateral as the primary source of repayment of the loan if the borrower does not pay.

Capacity to Pay

A private lender will also review the borrowers income and cash flow, in order to determine the borrowers capacity, or ability, to pay the contemplated loan. The debt to income ratio (DTI) will also come into play. The private lender most likely will not be able to tell you a specific DTI ratio they are looking for, for a DTI ratio of 55% for someone who earns $40,000/year would be completely different from someone with the same DTI ratio making $400,000/year. The hard money lender is, once again, less concerned with income and assets as opposed to the private lender, although it is certainly not completely ruled out.

Workability

The private lender, throughout the investing process, is much more involved and willing to work out problems should they arise (which they most certainly will). A hard money lender is generally not amenable to helping you work out of your problems. Possessing the collateral backing the loan is appealing to the hard money lender. Consequently, they are not as worried about repayment and are less willing to lend a helping hand.

Loan Structuring

Money from both private rehab lenders and hard money rehab lenders are more expensive than traditional lenders, but both private money rehab loans and hard money rehab loans are high risk and labor intensive from the lenders perspective.

Traditionally, the private rehab lender will be able and willing to offer more favorable loan terms than the hard money lender and are generally more willing to tailor loan documents and programs to fit a borrowers needs when structuring a loan, as the private lender has been able to mitigate its risk by fully underwriting the borrower financially.

This directly correlates to the previous point about workability. By using collateral in the deal, incentive to monitor the project decreases greatly compared to that of the private lenders. In essence, collateral effects the mindset of the lender providing funding while the loan is outstanding, often in a negative way.

Private Money vs. Hard Money Conclusion

Of course, all private and hard money lenders conduct business with slight differences here and there, but as a general rule of thumb, the above chart is what youll find when looking for funding for your flip.

Of course, all private and hard money lenders conduct business with slight differences here and there, but as a general rule of thumb, the above chart is what youll find when looking for funding for your flip.

Research like this article presents is essential to decision process, because in the end, it will be you who decides whether private, hard, conventional, or other forms of funding are fit for your real estate investing future. Also sometimes knowing whether the real estate deal requires a quick closing or access to rehabbing funds will guide you to the best financing option available to you as an investor.

Did you get your FREE (ebook) for REIClub investors on Real Estate Investing: How to Find Private Money Lenders?

We love your feedback and welcome your comments.

Please post below: